UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

☑ Filed by the Registrant ☐ Filed by a Partyparty other than the Registrant

CHECK THE APPROPRIATE BOX:

| | | | | | | | |

| ☐ | Preliminary Proxy Statement | |

| | |

| ☐ | Confidential, Forfor Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| | |

| ☑ | Definitive Proxy Statement | |

| | |

| ☐ | Definitive Additional Materials | |

| | |

| ☐ | Soliciting Material Pursuant to Rule 14a-12 | |

| | |

Carrier Global Corporation

(Name of the Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX)ALL BOXES THAT APPLY):

| | | | | | | | |

| ☑ | No fee required.required | |

| | |

| ☐ | Fee paid previously with preliminary materials | |

| | |

| ☐ | Fee computed on the table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.0-11 | |

| | 1) Title of each class of securities to which transaction applies: |

| 2) Aggregate number of securities to which transaction applies: | |

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4) Proposed maximum aggregate value of transaction: | |

| 5) Total fee paid: | |

| | |

☐ | Fee paid previously with preliminary materials. | |

| | |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| 1) Amount Previously Paid: | |

| 2) Form, Schedule or Registration Statement No.: | |

| 3) Filing Party: | |

| 4) Date Filed: | |

| | |

| | | | | | | | | | | | | | |

| | | Global Leader in Intelligent Climate and Energy Solutions |

| | | |

|

DRIVING SUSTAINABILITY.Transformation begins with belief. That innovation can make an impact. That taking care of people means taking care of the planet. That our solutions have the power to improve life today and tomorrow. It is why Carrier is transforming spaces every day. In homes. In buildings. Across the cold chain. Our inclusive, diverse team combines global and local expertise with an uncompromising commitment to customers. Together, we deliver intelligent, connected ecosystems and visionary breakthroughs that help support comfort, health and productivity while promoting sustainable energy usage.

INSPIRING CONFIDENCE.We are Carrier. A global leader in intelligent climate and energy solutions. For people, our planet and generations to come.

|

| | | |

| | | |

The time to shape a more healthy, safe, sustainable and intelligent world is now. | | | At Carrier, we are meeting the moment. In the face of critical challenges, we are driving sustainability through ambitious goals, bold initiatives and innovative solutions that empower our customers to make a positive impact. We are living and breathing our commitment to an inclusive, diverse culture. We are promoting the health and safety of indoor spaces where people live, work, learn and play, and preserving, protecting and extending the supply of food and medicine across the globe. In moments big and small, Carrier is inspiring confidence. |

| | | |

The Carrier Way

2021 PerformanceThe Carrier Way is our foundation, our north star. It defines our vision, values and cultural behaviors that allow us to create a workplace where we work and win, together, and always with a focus on delivering excellence, the right way.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

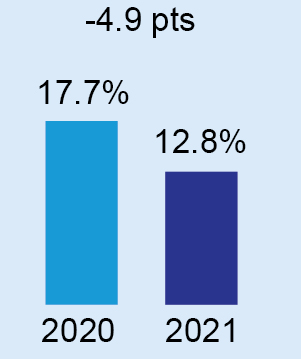

| | Financial Highlights — GAAP | | |

| Net sales

(dollars in billions)

| Operating profit

(dollars in billions)

| Operating margin

(percent)

| Earnings per share

(dollars per share)

| Net cash flows from

operating activities

(dollars in billions)

| |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

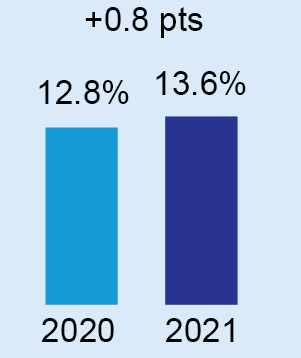

| Financial Highlights — Adjusted* | | | |

| Net sales

(dollars in billions)

| Adjusted

operating profit

(dollars in billions)

| Adjusted

operating margin

(percent)

| Adjusted diluted

earnings per share

(dollars per share)

| Free cash flow

(dollars in billions)

| |

| | | | | | |

| | | | | | |

| | | | | | |

| * See Appendix A beginning on page 62 for information regarding non-GAAP measures and a reconciliation of each non-GAAP measure to the most comparable GAAP measure. |

▪We booked approximately $500 million in healthy building orders. We launched Abound, a cloud-based building platform that enables owners, tenants and visitors to assess and improve indoor air quality. It provides transparency into actionable insights to help enhance occupant experiences while achieving sustainability targets.

▪Our Lynx cloud-based digital offering, developed in collaboration with Amazon Web Services, was recognized by Fast Company as one of 2021’s World Changing Ideas, based on its ability to enable the safe movement, monitoring and storage of vaccines around the world.

▪More than 30% of our 2021 residential heating sales in North America consisted of heat pumps, reflecting consumer demand for energy efficiency. We began offering zero-emission electric truck refrigeration technology, along with an air-cooled chiller heat pump platform in Europe with 70% lower global warming potential than our previous platforms.

▪Subscriptions of digitally enabled aftermarket offerings increased in 2021, reflecting strong demand for our differentiated IoT solutions.

NOTICE OF 2022 ANNUAL MEETING OF SHAREOWNERS

| | | | | | | | | | | | | | |

| |

Meeting

Information

| | DATE AND TIME

April 14, 2022

8 a.m. Eastern time

| | LOCATION

Virtual Meeting

www.virtualshareholdermeeting.com/CARR2022

|

| |

| | | | | | | | | | | | | | | | | |

| |

Agenda | | | BOARD

RECOMMENDATION

| READ

MORE

|

| 1 | Election of the Eight Director Nominees Named in the Proxy Statement | | | |

| FOR each Director Nominee

| ► Page 9 |

| | | | | |

| 2 | Advisory Vote to Approve Named Executive Officer Compensation | | | |

| FOR | ► Page 29 |

| | | | | |

| 3 | Ratify Appointment of PricewaterhouseCoopers LLP to Serve as Independent Auditor for 2022 | | | |

| FOR | ► Page 53 |

| | | | | |

| 4 | Other Business, if Properly Presented | | | |

| |

| | | | | | | | | | | | | | |

| |

Four voting methods are available to you. | | BY THE INTERNET

Visit the website on your proxy card.

| | BY MAIL

Sign, date and return your proxy card in the enclosed envelope.

|

Please review your Proxy Statement and vote in one of the ways described here. | | | | |

| BY TELEPHONE

Call the telephone number on your

proxy card.

| | ONLINE DURING THE MEETING

Vote online during the meeting by going to: www.virtualshareholdermeeting.com/CARR2022

|

| |

| | | | | |

Your vote is important. Please submit your proxy or voting instructions as soon as possible. | WHO MAY VOTE

If you owned shares of Carrier common stock at the close of business on February 22, 2022 (the record date for this Annual Meeting), then you are entitled to receive this Notice and to vote at the Annual Meeting.

THE 2022 ANNUAL MEETING IS VIRTUAL

Because of the ongoing COVID-19 pandemic, we have adopted a virtual meeting format for this Annual Meeting to protect the health of our shareowners, directors and employees. Shareowners can participate from any geographic location with internet connectivity. Please see page 55 for more information about participating in the virtual meeting.

By Order of the Board of Directors.

Mark G. Thompson

Vice President, Secretary & Deputy Legal Officer

|

TABLE OF CONTENTS

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

About Carrier | |

| |

Our Business Segments | 2 |

| |

Innovation Spotlight | 2 |

| |

Our Programs | 3 |

| |

| |

Environmental, Social & Governance | 4 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareowners to be held on April 14, 2022.This Notice of the 2022 Annual Meeting of Shareowners and Proxy Statement as well as Carrier’s 2021 Annual Report are available free of charge at www.proxyvote.com or at www.corporate.carrier.com. References in either document to our website are for the convenience of readers, and information available at or through our corporate website is not a part of nor is it incorporated by reference in the Proxy Statement or Annual Report.

The Board of Directors of Carrier Global Corporation is soliciting proxies to be voted at our 2022 Annual Meeting of Shareowners on April 14, 2022, and at any postponed or reconvened meeting. We expect that the Proxy materials or a notice of internet availability will be mailed and made available to shareowners beginning on or about March 1, 2022. At the meeting, votes will be taken on the matters listed in the Notice of 2022 Annual Meeting of Shareowners.

| | | | | |

ii | Carrier Global Corporation |

MESSAGE FROM OUR

LEAD INDEPENDENT DIRECTOR

| | | | | | | | |

| | Dear Fellow Shareowners,

2021 was a transformational year for the Carrier Board of Directors. We completed a leadership succession plan and added a new director. In April, David Gitlin, Carrier’s CEO, was appointed Chairman of the Board. We are grateful to John Faraci who, as Executive Chairman, led our Board through its first year as an independent public company in the midst of the COVID-19 pandemic.

In June, we appointed Beth Wozniak, CEO of nVent Electric plc, as an independent director and member of our Governance Committee. Beth's deep understanding of technology and the role it plays in building environments complements the Board’s already diverse array of skills and experience. She will provide valuable insight and perspective as we oversee the execution of Carrier’s enterprise strategy to be the world leader in healthy, safe, sustainable and intelligent building and cold chain solutions.

We also took significant action last year to strengthen Carrier’s corporate governance. We enhanced shareowner rights in our Bylaws, reaffirmed our commitment to diversity and to Carrier’s stakeholders in our Corporate Governance Principles, strengthened the Board’s oversight of potential conflicts of interest in our Related Person Transactions Policy, and improved management’s alignment with the interests of our shareowners by expanding the equity ownership rules in our Share Ownership Requirements Policy.VISION

Our priority remains the same:aspiration; why we come to ensure that the Board is effective in guiding Carrier to sustainable, long-term value creation. We will continue to ensure that we maintain the optimal blend of skills and experience at the Board and management level, as well as meaningful engagement with our shareowners.work every day. As always, we greatly value your investment in Carrier and your faith and confidence in our passion for creatingCreating solutions that matter for people and our planet.

|

| | |

| | VALUES Our absolutes; always do the right thing. Respect Integrity Inclusion Innovation Excellence |

| | |

| | CULTURE Our behaviors; how we work and win together, while never compromising our values. |

| | |

| | Passion for Customers We win when our customers win. | Achieve Results We perform, with integrity. |

| | | |

| | Play to Win We strive to be #1 in everything we do. | Dare to Disrupt We innovate and pursue sustainable solutions. |

| | | |

| | Choose Speed We focus and move with a bias for action. | Build Best Teams We develop diverse teams, and empower to move faster. |

| | |

Code of Ethics and Corporate Policy Manual

Our Code of Ethics focuses on the core values that serve as the foundation of our culture: respect, integrity, inclusion, innovation and excellence. It embodies our culture and the values that guide how we operate and achieve our goals the right way. Employees are required to annually review and acknowledge their adherence to our Code of Ethics. We encourage you to visit the Corporate Responsibility section of our website (www.corporate.carrier.com), to access Carrier’s Code of Ethics, excerpts from our Corporate Policy Manual and Environmental, Social and Governance ("ESG") framework documents.

MESSAGE FROM OUR LEAD INDEPENDENT DIRECTOR

| | | | | | | | |

| | Dear Fellow Shareowners, In 2023, Carrier took bold action to simplify its portfolio and accelerate its journey to becoming a pure-play global leader in intelligent climate and energy solutions. With the acquisition of Viessmann Climate Solutions and the planned exit of Carrier’s Fire & Security segment and commercial refrigeration business, Carrier is becoming a more focused company, well-positioned to deliver higher growth and superior value to its shareowners. The Carrier Board shares the management team’s vision of “performing while transforming” and is pleased to welcome Maximilian (Max) Viessmann as our newest director following the successful acquisition of Viessmann Climate Solutions. Max’s groundbreaking vision in digital transformation and deep knowledge of the climate and energy industries will be invaluable as Carrier continues to propel its growth strategy. 2023 was also a transition year for our Board. I began my tenure as Lead Independent Director, succeeding Dr. J.P. Garnier who, fortunately, has agreed to extend his service on the Board until 2025. His extensive global experience and deep understanding of our industry has been and will continue to be invaluable to us during this transformative period. Michael Todman and Virginia Wilson also ably stepped into new roles in 2023 as chairs of our Compensation and Governance committees. I am proud to serve on a board that is so well-positioned to guide Carrier’s management team in its mission to deliver outsized and sustainable value to shareowners. Our Board remains committed to maintaining robust oversight, especially on important governance issues. During the year, responsibility for Carrier's Environment, Social and Governance programs, goals and objectives was elevated to the full Board. This included expanding our disclosures, one of which was our submission to the Carbon Disclosure Project. Additionally, we oversaw the strengthening of Carrier's cybersecurity programs through enhanced public disclosures, external maturity assessments and a formalized governance structure to escalate critical cybersecurity risks and incidents to the Board. To further align the interests of Carrier management with those of its shareowners, we expanded Carrier’s share ownership requirements in 2023 to apply to all members of Carrier’s Executive Leadership Team. Carrier’s transformation is not just about adapting to change; it’s about embracing it. The Carrier Board will continue to help guide Carrier to sustainable, long-term value creation and engage with you, our shareowners, along the way. As shareowners, your trust and support have been instrumental in Carrier’s journey thus far, and we are committed to delivering long-term, sustainable value to you.

Sincerely, Jean-Pierre Garnier, Ph.D.John J. Greisch

Lead Independent Director |

"Our priority remains the same:Carrier’s transformation is not just about adapting to ensure that thechange; it’s about embracing it. The Carrier Board is effective in guidingwill continue to help guide Carrier to sustainable, long-term value creation.creation and engage with you, our shareowners, along the way." | |

| |

TABLE OF CONTENTS

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareowners to be held on April 18, 2024.This Notice of the 2024 Annual Meeting of Shareowners and Proxy Statement as well as Carrier’s 2023 Annual Report are available free of charge at www.proxyvote.com or at www.corporate.carrier.com. References in either document to our website are for the convenience of readers, and information available at or through our corporate website is not a part of nor is it incorporated by reference in the Proxy Statement or Annual Report.

The Board of Directors of Carrier Global Corporation (the "Board") is soliciting proxies to be voted at our 2024 Annual Meeting of Shareowners on April 18, 2024, and at any postponed or reconvened meeting. We expect that the Proxy materials or a notice of internet availability will be mailed and made available to shareowners beginning on or about March 5, 2024. At the meeting, votes will be taken on the matters listed in the Notice of 2024 Annual Meeting of Shareowners.

| | | | | |

| ii | Carrier Global Corporation |

NOTICE OF 2024 ANNUAL MEETING OF SHAREOWNERS

| | | | | | | | | | | | | | |

| |

Meeting Information | | DATE AND TIME April 18, 2024 8:30 a.m. Eastern time | | LOCATION Virtual Meeting www.virtualshareholdermeeting.com/CARR2024 |

| |

| | | | | | | | | | | | | | | | | |

| |

| Agenda | | | BOARD RECOMMENDATION | READ MORE |

| 1 | Election of the Ten Director Nominees Named in the Proxy Statement | | | |

| FOReach Director Nominee | |

| | | | | |

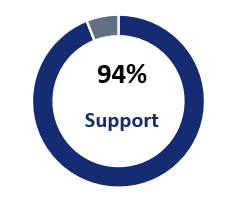

| 2 | Advisory Vote to Approve Named Executive Officer Compensation | | FOR | |

|

| | | | | |

| 3 | Ratify Appointment of PricewaterhouseCoopers LLP to Serve as Independent Auditor for 2024 | | | |

| FOR | |

| | | | | |

| 4 | Vote on the Shareowner Proposal set forth in the Proxy Statement, if properly presented | | | |

| AGAINST | |

| |

| | | | | | | | | | | | | | |

| |

| Four voting methods are available to you. | | BY THE INTERNET Visit the website on your proxy card. | | BY MAIL Sign, date and return your proxy card in the enclosed envelope. |

| | | | |

| Please review your Proxy Statement and vote in one of the ways described here. | | BY TELEPHONE Call the telephone number on your proxy card. | | ONLINE DURING THE MEETING Vote online during the meeting by going to: www.virtualshareholdermeeting.com/CARR2024. |

| |

| | | | | |

Your vote is important. Please submit your proxy or voting instructions as soon as possible. | WHO MAY VOTE You are entitled to receive this Notice and to vote at the Annual Meeting if you owned shares of Carrier common stock at the close of business on February 27, 2024 (the record date for this Annual Meeting). VIRTUAL MEETING FORMAT The 2024 Annual Meeting of Shareowners will continuebe conducted in a virtual format to facilitate attendance and to provide a consistent experience to all shareowners, regardless of location. The format is designed to ensure that we maintaina level of participation commensurate with an in-person meeting and allows shareowners to: ▪vote and submit questions in advance of the optimal blendAnnual Meeting; and ▪access a live webcast, vote and submit questions during the Annual Meeting on April 18, 2024. Please see "Frequently Asked Questions About the Annual Meeting" on page 68 for more information about participating in the virtual meeting. By Order of skills and experience at the Board and management level, as well as meaningful engagement with our shareowners." | |

| of Directors.

Francesca Campbell

| Vice President, Corporate Secretary |

| | | | | |

20222024 Proxy Statement | 1 |

PROXY SUMMARY

This summary highlights selected information contained elsewhere in this Proxy Statement. It does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

Voting Matters

We request that you vote on the following proposals at the 2024 Annual Meeting:

| | | | | | | | | | | | | | |

| Proposal | | Board Recommendation | Page |

| Proposal 1 | Election of the 10 Director Nominees Named in the Proxy Statement | VoteFOR each director nominee | |

| Proposal 2 | Advisory Vote to Approve Named Executive Officer Compensation | VoteFOR | |

| Proposal 3 | Ratify Appointment of PricewaterhouseCoopers LLP to Serve as Independent Auditor for 2024 | VoteFOR | |

| Proposal 4 | Shareowner Proposal – Transparency in Lobbying | VoteAGAINST | |

Director Nominees and Governance

| | | | | | | | | | | |

| | | |

| Election of Directors |

What are you voting on? At the 2024 Annual Meeting,10 director nominees are to be elected to hold office until the 2025 Annual Meeting and until their successors have been elected and qualified. | All nominees are current directors of Carrier and were elected by shareowners at the 2023 Annual Meeting, except for Max Viessmann who joined the Board in January 2024. |

| | | |

| | Our Board recommends a voteFOR each nominee |

| | | |

| | | | | | | | | | | | | | |

| | | | |

| Jean-Pierre Garnier, 76 Former Chief Executive Officer, GlaxoSmithKline plc Director Since: 2020 Other Current Directorships: Cellectis S.A. | | | Susan N. Story, 64 Former President & Chief Executive Officer, American Water Works Company, Inc. Director Since: 2023 Other Current Directorships: Dominion Energy, Inc., Newmont Corporation |

| | | | |

| | | | |

| | | | |

| David L. Gitlin, 54 Chairman & Chief Executive Officer, Carrier Global Corporation Director Since: 2020 Other Current Directorships: The Boeing Company | | | Michael A. Todman, 66 Former Vice Chairman, Whirlpool Corporation Director Since: 2020 Other Current Directorships: Brown-Forman Corporation, Prudential Financial, Inc., Mondelez International, Inc. |

| | | | |

| | | | |

| | | | |

| John J. Greisch, 68 Former President & Chief Executive Officer, Hill-Rom Holdings, Inc. Director Since: 2020 Other Current Directorships: Catalent Inc., Viant Medical | | | Max Viessmann, 35 Chief Executive Officer & Member of the Executive Board, Viessmann Group GmbH & Co. KG Director Since: 2024 Other Current Directorships: Viessmann Group GmbH & Co. KG |

| | | | |

| | | | |

| | | | |

| Charles M. Holley, Jr., 67 Former Executive Vice President & Chief Financial Officer, Wal-Mart Stores, Inc. Director Since: 2020 Other Current Directorships: Amgen, Inc., Phillips 66, Sunrise Group Holdings, LLC | | | Virginia M. Wilson, 69Former Senior Executive Vice President & Chief Financial Officer, Teachers Insurance and Annuity Association of America Director Since: 2020 Other Current Directorships: Charles River Laboratories International, Inc. |

| | | | |

| | | | |

| | | | |

| Michael M. McNamara, 67 Co-Founder & Chief Executive Officer, Samara; Former Chief Executive Officer, Flex Ltd. Director Since: 2020 Other Current Directorships: Workday, Inc. | | | Beth A. Wozniak, 59 Chief Executive Officer, nVent Electric plc Director Since: 2021 Other Current Directorships: nVent Electric plc |

| | | | |

| | | | | |

| 2 | Carrier Global Corporation |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Board Nominees | Sound Corporate Governance ▪Regular reviews of strategic direction and priorities ▪Regular reviews of significant risks; active oversight of Enterprise Risk Management ("ERM") program ▪Annual review of Board policies, governance practices and committee charters ▪Annual Board, committee and director evaluations; regular refreshment actions ▪80% of director nominees are independent ▪Robust Lead Independent Director with explicit responsibilities ▪Regular meetings of independent directors led by Lead Independent Director ▪Annual election of all directors ▪Majority voting for directors in uncontested elections ▪Rigorous share ownership requirements for directors and senior management ▪Directors required to hold company-granted equity until retirement ▪Hedging, short sales and pledging of Carrier securities prohibited ▪Eligible shareowners can make proposals and nominate directors through proxy access ▪Shareowners may act by written consent ▪15% of shareowners may call special meetings ▪No supermajority shareowner voting requirements ▪98% attendance at Board meetings in 2023 ▪96% attendance at committee meetings in 2023 |

| | | | | | | | | | | | | | | | | | | | | | | |

TENURE 3.3 years average tenure | AGE 63 average age |

7 members on Board since separation from UTC | 3 new Board members in last 3 years | 3 < 60 years | 1 60-65 years | 6 > 65 years | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

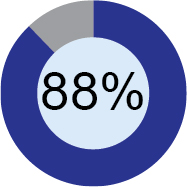

DIVERSITY 4 of 10 (40%) Board nominees are diverse 2 of 5(40%) Board leadership positions are held by diverse members Our policy is to build a board representing a broad range of personal characteristics and diversity of perspectives | INDEPENDENCE Our 10-member Board of Directors includes our Chairman & Chief Executive Officer, one additional non-independent director and eight independent directors All independent directors meet the heightened independence standards for our Audit Committee and Compensation Committee |

3 Female (30%) | 1 Racially Diverse (10%) | 8 Independent (80%) | 2 Not Independent (20%) |

Susan N. Story Virginia M. Wilson Beth A. Wozniak | Michael A. Todman | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Skills, Experience and Diversity Our director nominees' most significant skills, experience and attributes are highlighted in the following matrix. The matrix is intended as a high-level summary and not an exhaustive list of each director's skills or contributions to the Board. Board committees reflect committee memberships as of the date of this Proxy Statement. | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | KEY SKILLS, EXPERIENCES AND ATTRIBUTES | | | | | |

| | | | | | | | | | | BOARD COMMITTEES | |

| NAME | A | C | G | T | |

| Jean-Pierre Garnier | | | | | | | | | | |

| |

| |

| David L. Gitlin | | | | | | | | | | | | | | |

| John J. Greisch | | | | | | | | | | |

| |

| |

| Charles M. Holley, Jr. | | | | | | | | | |

| |

| | |

| Michael M. McNamara | | | | | | | | | | | |

|

| |

| Susan N. Story | | | | | | | | | |

|

| | | |

| Michael A. Todman | | | | | | | | | |

|

| | | |

| Max Viessmann | | | | | | | | | | | | | |

| |

| Virginia M. Wilson | | | | | | | | | |

| |

| | |

| Beth A. Wozniak | | | | | | | | | | | |

|

| |

| | | | | | | | | | | | | | | | | | | | | | | | |

| ATTENDANCE | | QUALIFICATIONS AND ATTRIBUTES | | | COMMITTEES | | | |

| Directors attended 98% of the meetings of the Board and 96% of the meetings of the committees on which they served in 2023. | | Financial | | Knowledge of Company/Industry | A Audit Committee C Compensation Committee G Governance Committee T Technology & Innovation Committee | | Member | |

| Human Capital Management | | Marketing/Sales | | Chair | |

| Innovation, Digital Technology and Cybersecurity | | Risk Management/Oversight | | | |

| International Business Operations | | Senior Leadership | | | | |

| | | Diversity | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

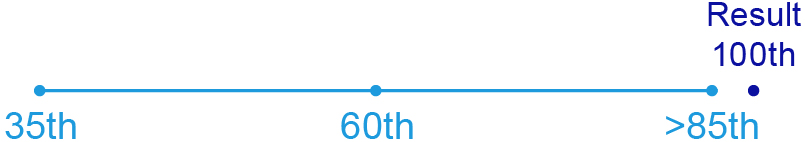

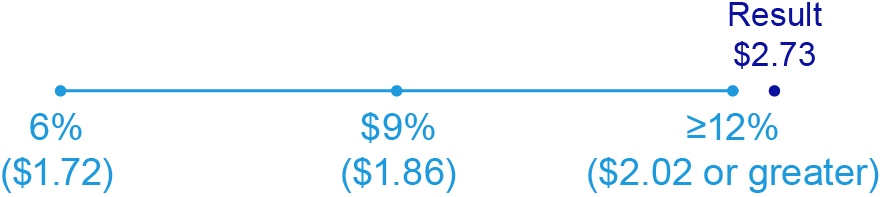

Executive Compensation and Performance

| | | | | | | | | | | |

| | | |

| Advisory Vote to Approve Named Executive Officer (NEO) Compensation |

What are you voting on? We are asking our shareowners to approve, on an advisory basis, the compensation paid to Carrier's named executive officers disclosed in this Proxy Statement. We hold say-on-pay votes annually. | The Board believes that our compensation policies and practices are effective in achieving the goals of the compensation program, and that our actions have been responsive to shareowner feedback related to last year’s say-on-pay vote. |

| | | |

| | Our Board recommends a voteFOR the say-on-pay proposal |

| | | |

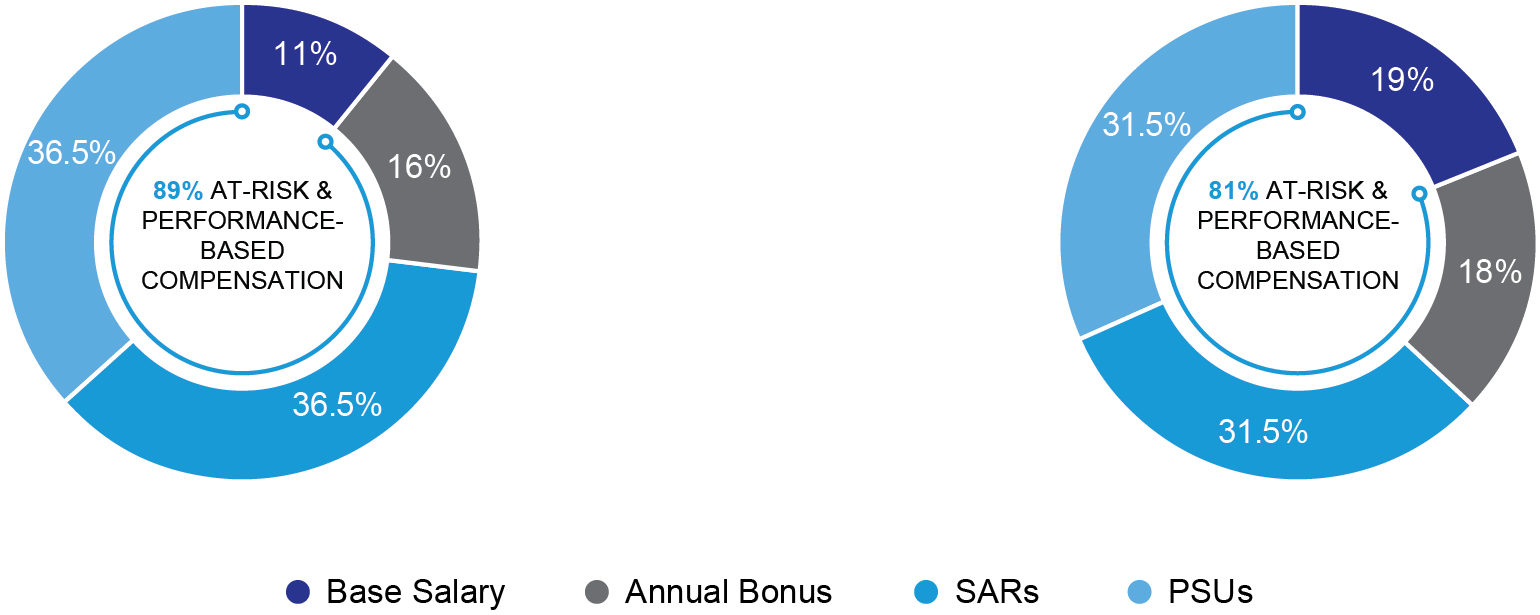

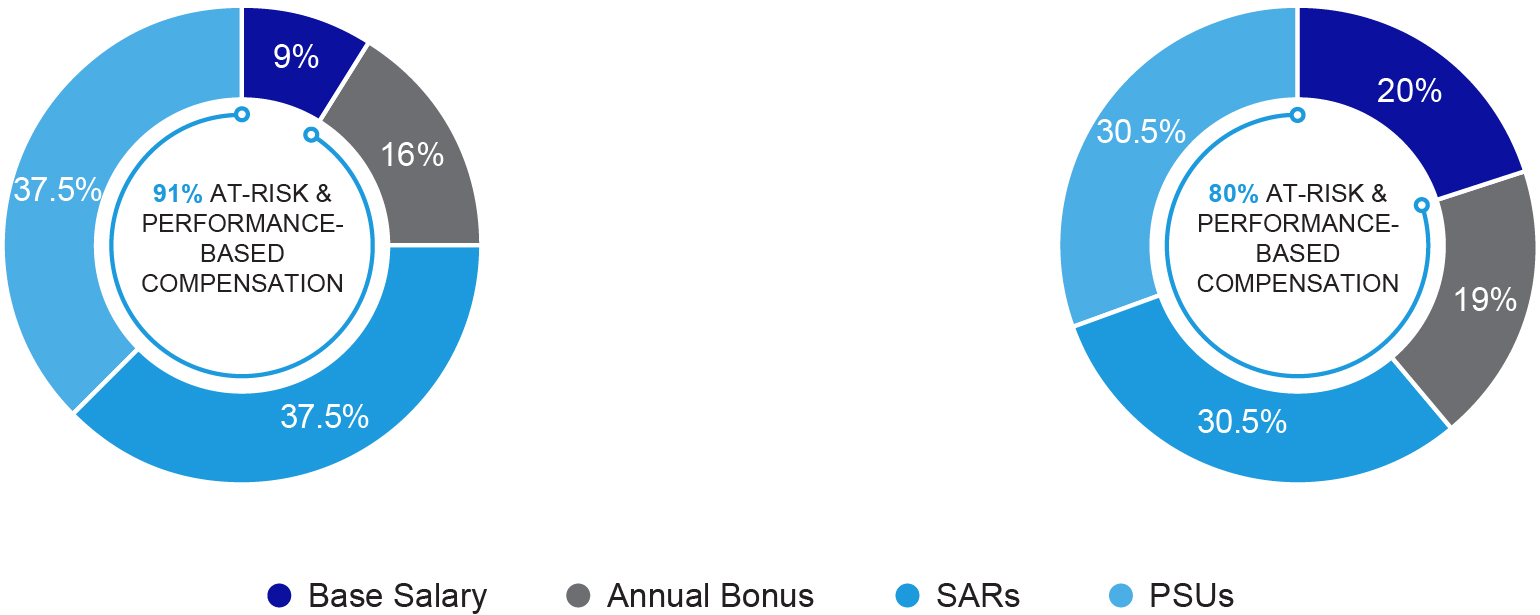

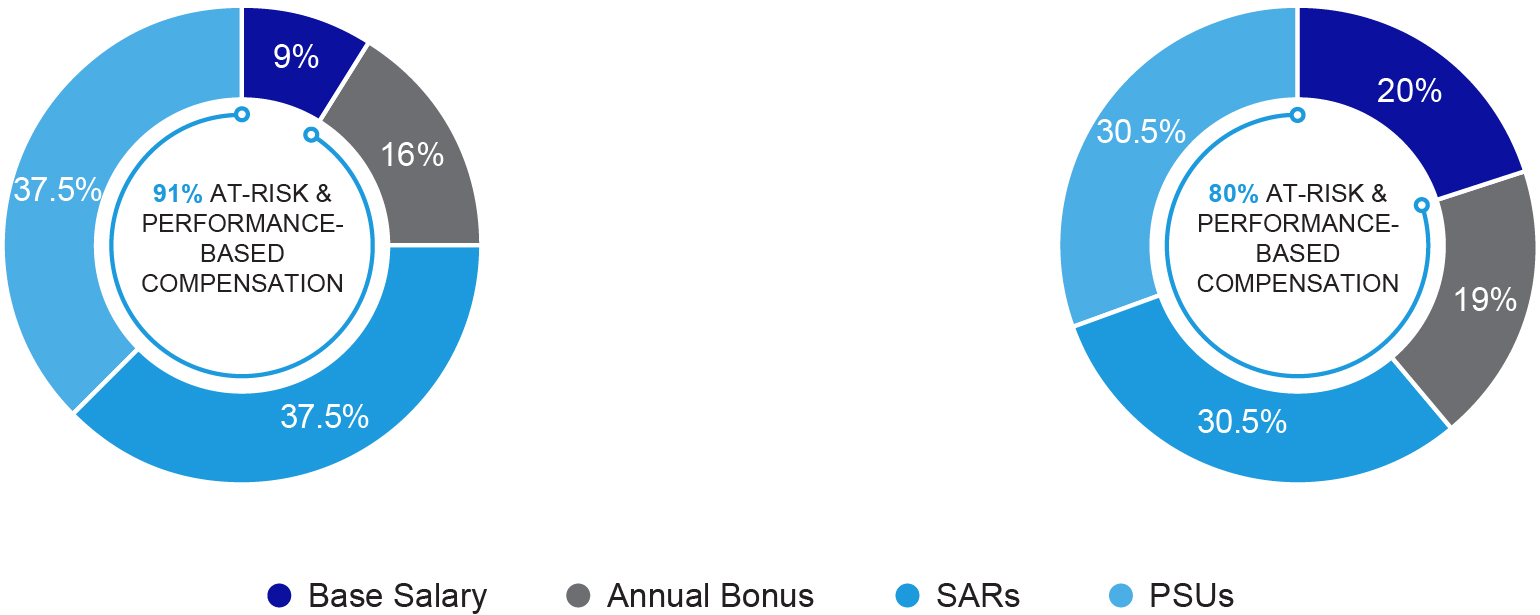

The overall objective of the compensation program is to encourage and reward the creation of sustainable, long-term shareowner value. The current elements of the executive compensation program directly align the interests of the executives and shareowners, are competitive, motivate achievement of short- and long-term financial goals and strategic objectives, and align realized pay with performance.

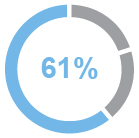

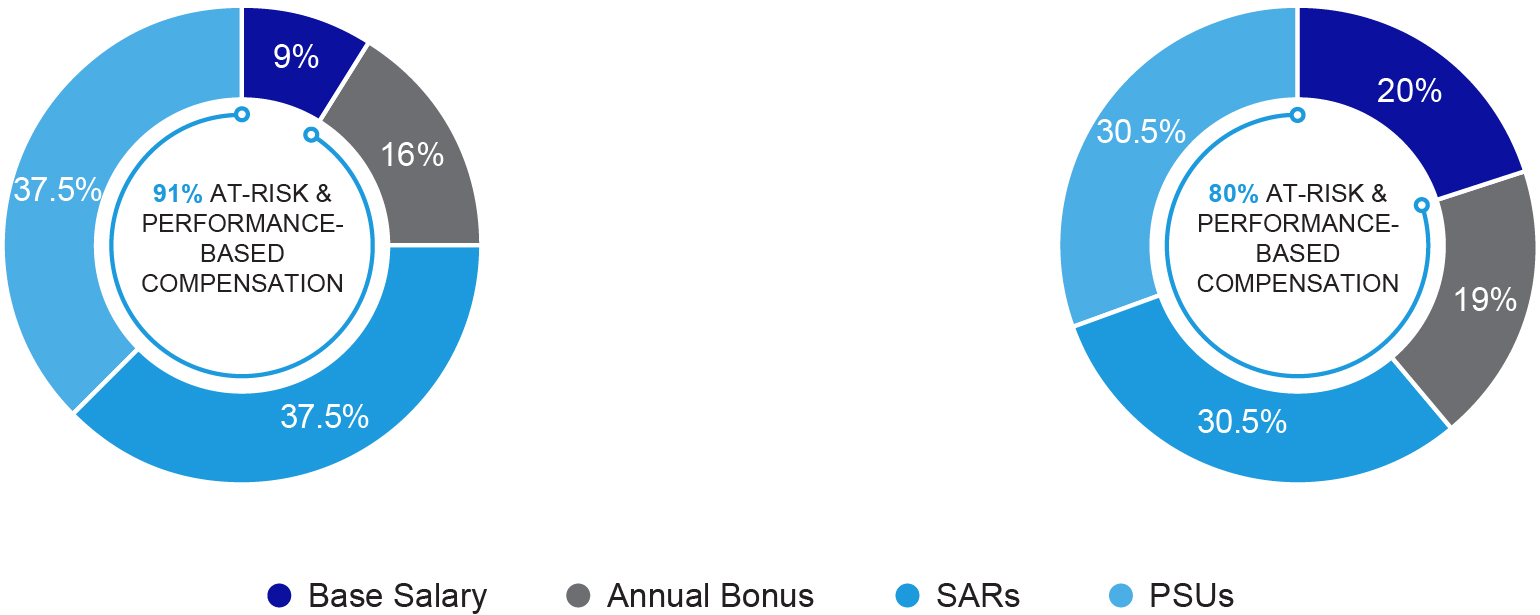

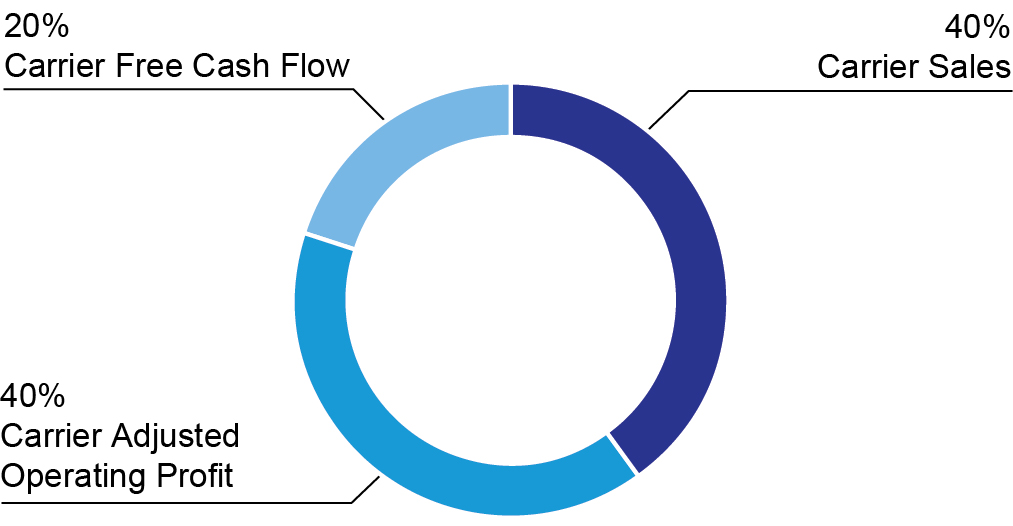

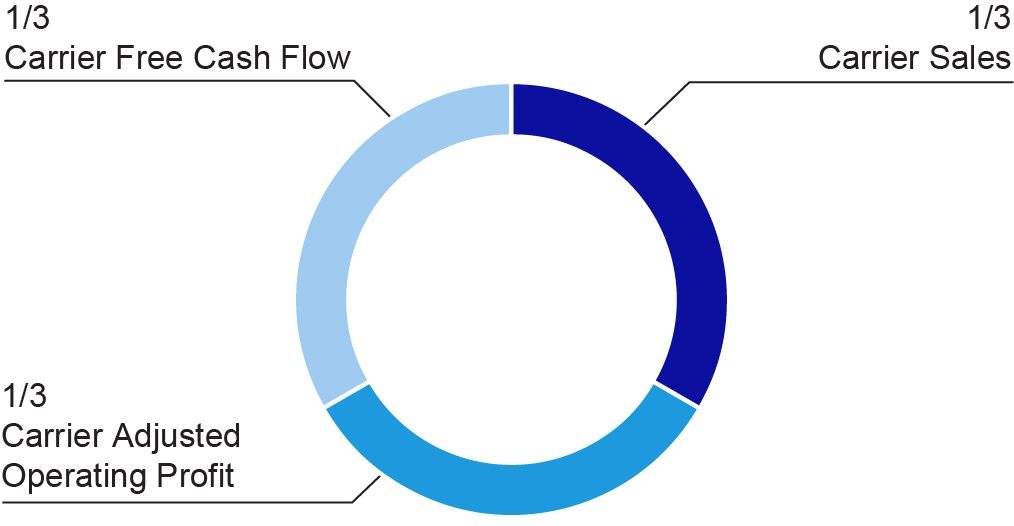

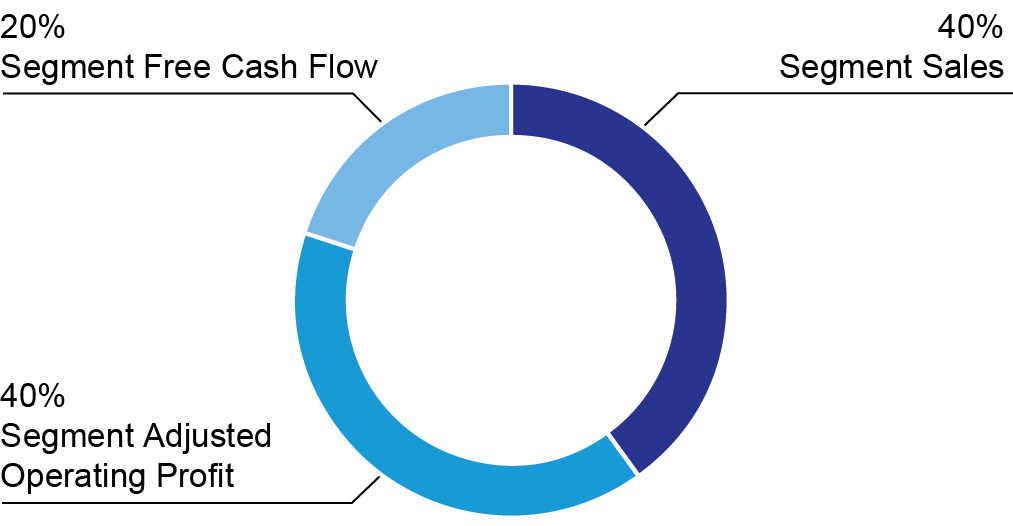

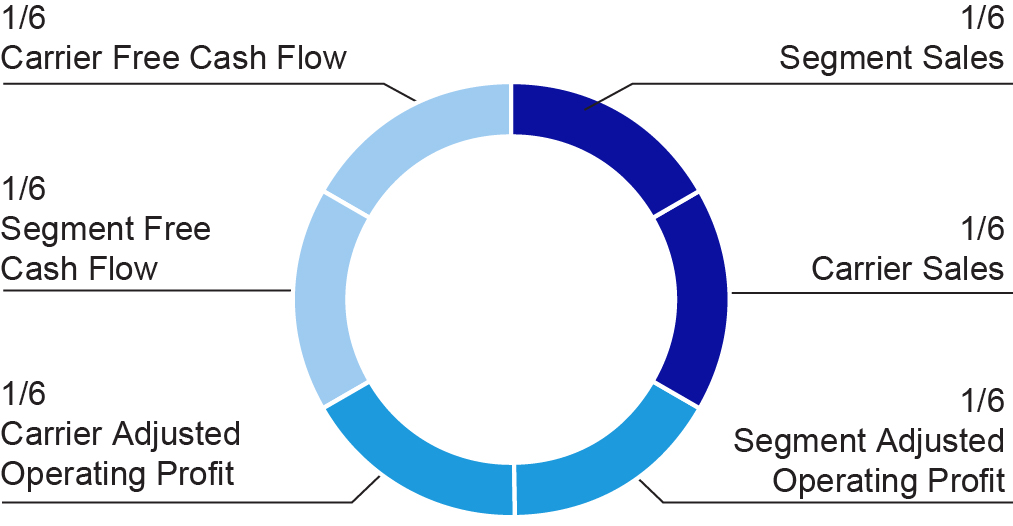

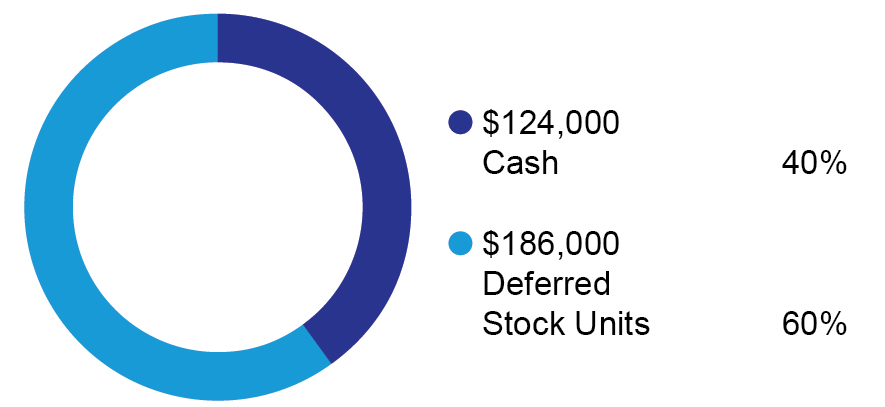

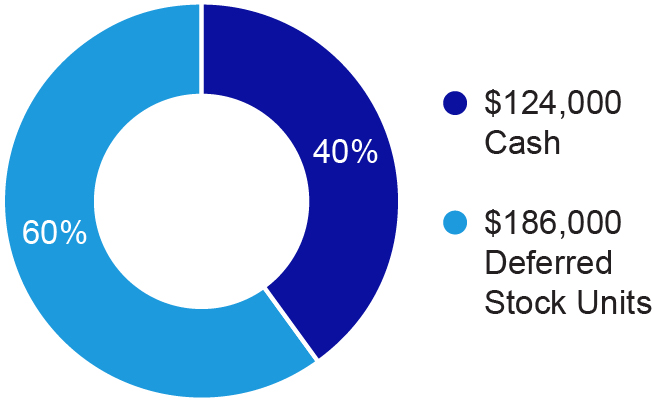

2023 Executive Compensation Program Principal Components

| | | | | | | | | | | | | | |

| ELEMENT | FORM OF AWARD | | | |

| PERIOD | | |

BASE

SALARY | | | | |

| Cash | One year | | |

| | | |

ANNUAL

BONUS | | | At-Risk Pay | Performance-Based Pay |

| Cash | One year |

| |

LONG-TERM

INCENTIVES

(LTI) | Stock Appreciation Rights (SARs)

50% | Vest after three years |

Performance Share Units (PSUs)

50% | Vest after three years |

For the calculations above, total target direct compensation for 2023 includes annual base salary, the target value of annual bonus compensation and the target value of annual LTI awards, but does not include the target value of other special, one-time grants (e.g., sign-on or retention equity awards).

| | | | | |

| 4 | Carrier Global Corporation |

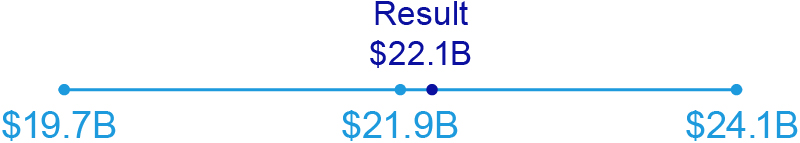

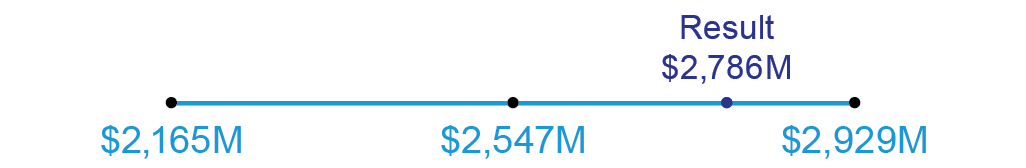

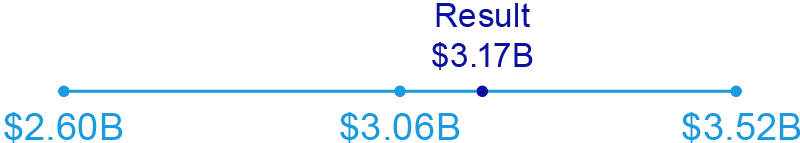

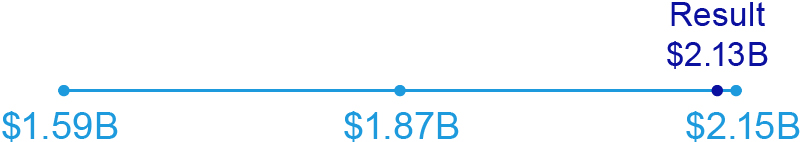

2023 Performance and Business Highlights

| | | | | | | | | | | |

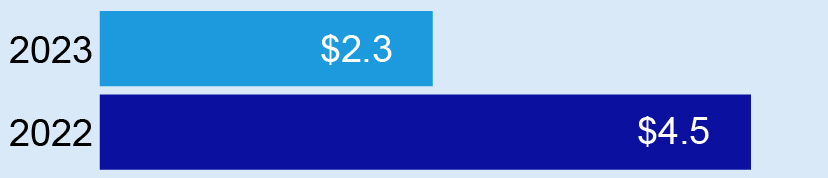

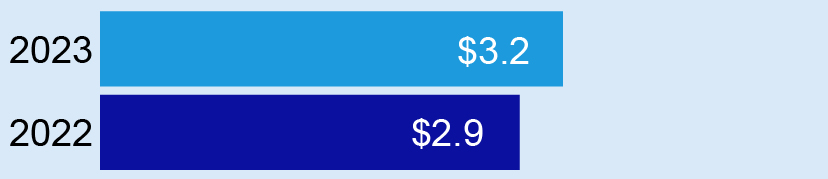

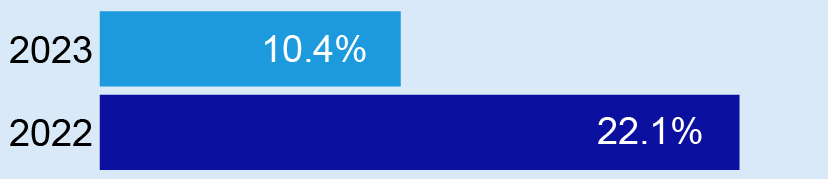

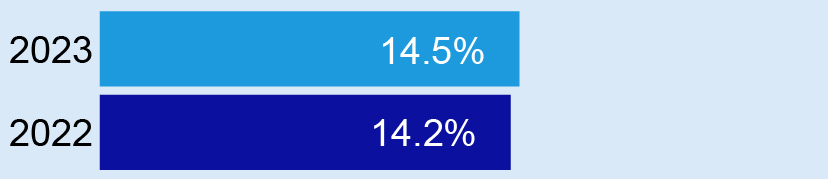

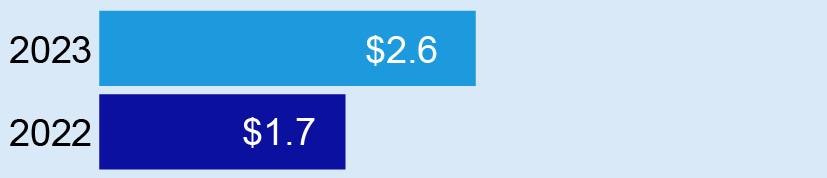

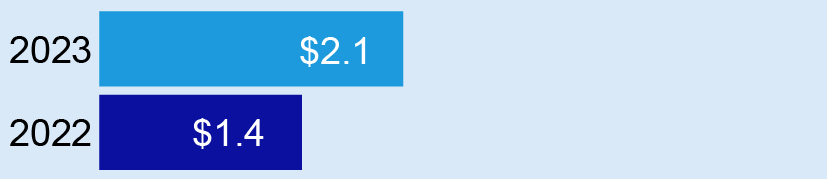

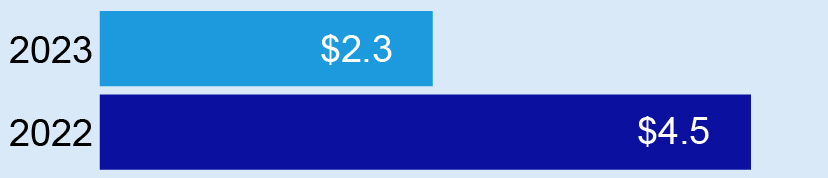

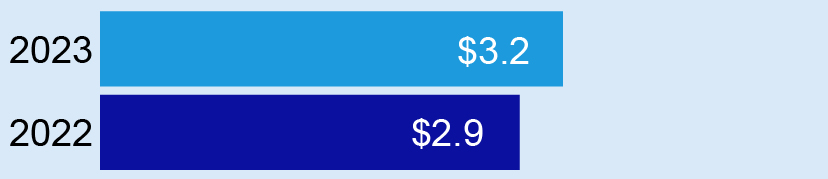

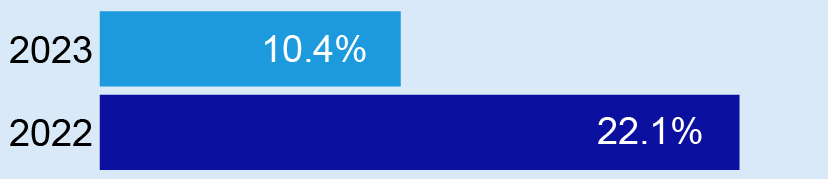

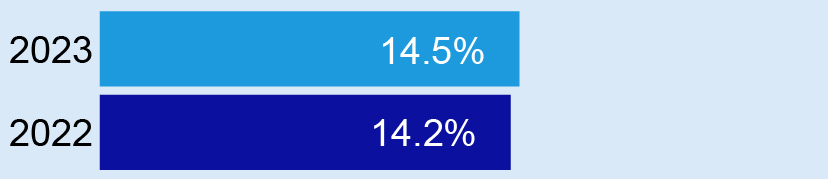

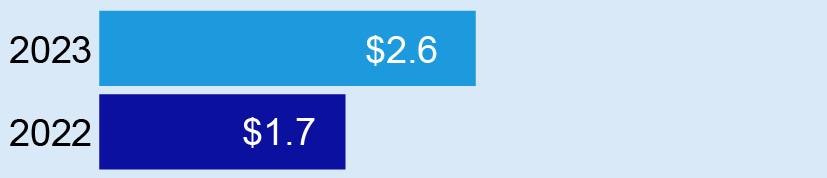

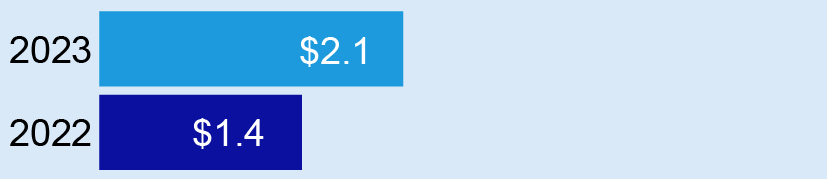

| GAAP | Adjusted* |

| | | |

Net sales (dollars in billions) | | |

| | | |

Operating profit (dollars in billions) | | |

| | | |

Operating margin (percent) | | |

| | | |

Earnings per share (dollars per share) | | |

| | | |

Net cash flows from operating activities/ Free cash flow (dollars in billions) | | |

| | | |

|

| *See Appendix A beginning on page 76 for information regarding non-GAAP measures and a reconciliation of each non-GAAP measure to the most comparable GAAP measure. |

|

| | | |

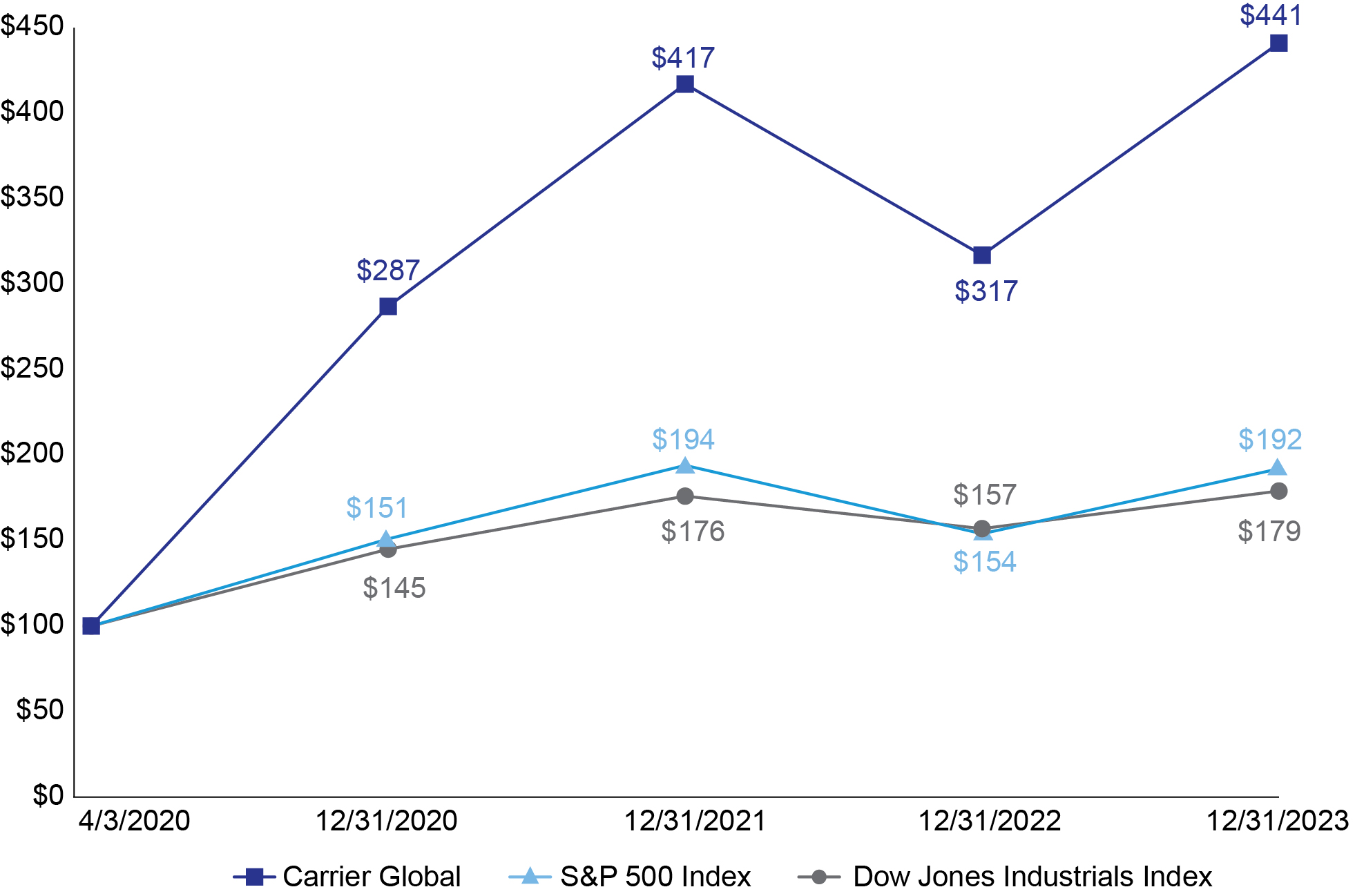

▪Carrier delivered strong 2023 operating performance as it started executing its portfolio transformation. In April 2023, the company announced its acquisition of Viessmann Climate Solutions, which was completed on January 2, 2024. ▪The company also announced plans to exit its Fire & Security segment and commercial refrigeration business. ▪2023 net sales increased 8% year-over-year, with organic sales growth of 3% primarily due to strong price realization. Carrier gained share in all major segments and grew aftermarket by double digits for a third consecutive year. ▪2023 GAAP operating profit, operating margin and earnings per share ("EPS") comparisons to 2022 were impacted by portfolio transformation-related activities in both periods, including large gains in 2022 associated with the increase in our ownership interest in Toshiba Carrier Corporation (TCC) and the sale of Chubb. ▪Adjusting for these and other non-operational items, Carrier had another year of strong financial performance resulting in double-digit adjusted operating profit growth and adjusted operating margin expansion.

| ▪Operating profit was lower compared to 2022 due to the previous year’s gains. Strong price/cost management and productivity drove the increase in adjusted operating profits in 2023. ▪Operating margin decreased 53% compared with last year primarily due to the portfolio transformation-related activities in 2023, while adjusted operating margin expanded 30 basis points despite a ~50-basis-point headwind from consolidating TCC, reflecting strong price/cost and productivity performance. ▪GAAP EPS and adjusted EPS benefited from strong operating performance along with lower net interest expense and a lower share count. GAAP EPS decreased as a result of portfolio transformation-related activities. ▪Cash from operating activities increased 50% versus the prior year driven by strong working capital performance. This also led to a free cash flow increase of 50% compared to 2022. |

| | | |

Independent Auditor

| | | | | | | | | | | |

| | | |

| Ratify Appointment of Independent Auditor for 2024 |

| What are you voting on? | |

| | | |

| We are asking our shareowners to ratify the appointment of PricewaterhouseCoopers LLP (“PwC”) as Carrier's independent registered public accounting firm for the fiscal year ending December 31, 2024. | The Audit Committee and the Board believe that the continued retention of PwC as our independent auditor is in the best interest of the company and our shareowners. |

| | | |

| | Our Board recommends a vote FOR the ratification of the appointment of PwC to serve as the company’s independent auditor for 2024 |

| | | |

OUR COMPANY

About Carrier

Carrier is the leadinga global provider of healthy, safe, sustainableleader in intelligent climate and intelligent building and cold chainenergy solutions, with a diverse and world-class workforce. Through our performance-driven culture, we are drivingcreating long-term shareowner value by growing salesearnings and investing strategically to strengthen our position in the markets we serve.

Our Business Segments

| | | | | |

| HVAC Carrier’s HVAC segment providesAs a global leader in intelligent climate and energy solutions, globally to meetCarrier is at the forefront of heating, ventilating and cooling needs ofsolutions for residential, commercial and commercialindustrial customers while enhancing building performance, energy efficiency and sustainability.around the world. Through an industry-leading family of HVAC brands, we offer anour global presence, and our innovative and complete portfoliodifferentiated digital solutions, we are transforming the built environment to be more energy efficient, sustainable and autonomous. Our solutions help customers achieve their targeted outcomes, including Abound, which monitors over 1.1 billion square feet of productsbuilding space to help improve indoor air quality, and solutions, including digital offerings, building automation and services that help optimize indoor environments to enhance human health, safetyoccupant comfort and productivity.

|

| |

| |

| Refrigeration Carrier’s Refrigeration segment providesCarrier is a more healthy, safe, sustainable and intelligentglobal leader in cold chain through the reliable transport and preservation of food, medicine and other perishable goods. Our refrigerationequipment and monitoring products, servicessolutions with the largest distribution network of nearly 1,700 dealers, distributors and service centers. We differentiate ourselves with both scale and technology to serve as a trusted partner throughout the cold chain. We are helping lead the shift toward electrification, more connected technologies and refrigerants with lower global warming potential. Carrier’s Lynx digital ecosystem offers a suite of advanced analytics solutions strengthen the connectedthat provides customers with enhanced visibility, increased connectivity and actionable intelligence across their cold chain and are designed for trucks, trailers, shipping containers, intermodal applications, food retail and warehouse cooling.operations.

|

| |

| |

| Fire & Security Carrier’s Fire & Security segment providesWith industry-leading brands like Kidde, Edwards, LenelS2, Det-Tronics and GST, customers trust us for all their safety and security needs, from the most complex jobs to the simplest conveniences. We offer a wide rangecomprehensive suite of residential, commercial and industriallifecycle solutions, connected technologies, designed to help save lives and protect people and property. Our globally recognized brands provide comprehensive solutions, including installation and maintenance, web-based and mobile applications and cloud-based services. We lead the market in innovation, from best-in-class water mist technology with Marioff to industry-first smart, integrated indoor air quality, smoke and carbon monoxide detectors for the home.

|

Innovation Spotlight

| | | | | |

|

|

| |

Abound, a cloud-based building platform, unlocks and unites building data to create more healthy, safe, sustainable and intelligent solutions for indoor spaces.It gathers data from disparate systems, sensors and sources; identifies opportunities to optimize performance; and works with healthy building solutions to improve occupant experiences.

| Carrier’s Lynx digital platform was recognized among Fast Company’s 2021 World Changing Ideas. Developed in collaboration with Amazon Web Services, the platform allows customers to leverage data to improve the effectiveness, efficiency and sustainability of their supply chains.

|

|

|

Secular Trends Driving GrowthAs a global leader in intelligent climate and energy solutions for buildings and homes, and across the cold chain, Carrier is uniquely positioned to lean into secular trends that are transforming our industry and the world. These trends include a growing middle class, climate change, energy security and stability, and digitalization.

As cities grow, competing demands for natural resources strain infrastructure and food supply. Heating and cooling of buildings and homes, together with food waste, contribute an estimated 25% of annual global greenhouse gas emissions,1 significantly impacting global warming and climate change.

Carrier is addressing these challenges head-on through breakthrough innovation, electrification, energy-efficient solutions, the use of refrigerants with lower global warming potential, connected ecosystems and more to help mitigate climate change and help enable the transition to clean energy.

1Based on estimates from the International Energy Agency, the U.S. Energy Information Administration and the UNEP Food Waste Index Report 2021.

| | | | | |

26 | Carrier Global Corporation |

Our Programs

| | | | | |

| |

| Portfolio Transformation | |

At Carrier, we are innovatingevolving our business to addresstake on the challenges of climate change. On January 2, 2024, we completed the acquisition of the climate solutions business (the “VCS Business”) of Viessmann Group GmbH & Co. KG (“Viessmann Group”). The addition positions Carrier as a digitally enabled, end-to-end sustainable climate and energy solutions provider that addresses all heating, cooling, renewables, solar photovoltaic technology, battery storage and energy management needs for the home and office. The combination enhances Carrier’s existing portfolio with access to the iconic Viessmann brand, a leading provider of peoplehighly efficient and our planet through our key programs – Healthy Buildings, Healthy Homesrenewable climate solutions with a more than 100-year record of innovation and Connected Cold Chain. These programs bring together Carrier’s expertise in healthy, safe, sustainable and intelligent solutions to inspire confidence every day and help solve global challenges. | | | We are shaping a healthier future through our Healthy Buildings Program. With solutions and services that help optimize indoor environments for health, safety and security, we positively impact occupant experiences in places where they live, work, learn and play, while helping to enhance sustainability and improve operational efficiency.a differentiated direct-to-installer channel model. In addition to our acquisition of Toshiba Carrier Corp. in 2022, Viessmann Climate Solutions’ 12,000 team members further strengthen Carrier’s position as the leading HVAC provider globally, now positioning Carrier in the fast-growing residential and light commercial space in Europe.

Carrier’s Healthy Homes Program includesThe acquisition of Viessmann Climate Solutions, together with the planned exits of our Fire & Security segment and commercial refrigeration business, will transform Carrier into a suite of targeted solutions that can help improvemore focused, higher-growth business, further strengthening the overall healthcompany’s global leadership position in intelligent climate and safety of homes and the people inside. Our businesses continue to introduce innovations that give people greater awareness and control of their home's health.

We are making the cold chain more healthy, safe, sustainable and intelligent through our Connected Cold Chain Program. Our solutions help preserve, protect and extend the supply of food, medicine and other perishables across the globe.energy solutions.

| |

| |

Advancing Solutions for Customers

Creating visionary breakthroughs for a better tomorrow

Carrier develops intelligent climate and energy solutions that support our commitment to achieving net-zero greenhouse gas emissions across our value chain by 2050. Our comprehensive offerings help customers reach and exceed their goals and stay ahead of regulatory changes.

We introduced more electric technologies and energy-efficient products to reduce dependency on fossil fuels, and we increased the use of refrigerants with lower global warming potential. We increased our annual investment in research and development, investing more than $2 billion in the last four years. In 2023, for the ninth year in a row, we released more than 100 new products. We also have more than 14,000 active patents and pending patent applications worldwide combined.

Carrier opened four additional i3 Labs in the United States, India, China and Japan. The innovation incubators are creative spaces where we ignite the development of disruptive technologies and empower our teams to test and develop solutions quickly, choosing speed to deliver differentiated customer solutions.

Building intelligent, connected ecosystems

Internally, we continued to invest in Carrier IO, a single platform for connecting assets to the cloud. We continued to reduce the complexity of our enterprise resource planning landscape, enabling more agile and cost-efficient internal operations. In addition, we implemented digital initiatives to optimize factory operations to expedite time to market, inform decision-making and streamline overall manufacturing processes.

Our new Generative AI Task Force is guiding the company’s secure and responsible use of AI technology to drive efficiency and innovation. By applying the power of generative AI, Carrier is tackling a range of high-impact use cases related to operational efficiency, customer experience and more.

Accelerating aftermarket growth through lifecycle solutions

Our portfolio of digitally enabled lifecycle solutions expanded with offerings such as Abound Net Zero Management, Lynx Logix, InteliSense and more. Our comprehensive aftermarket offerings include remote monitoring and diagnostics, predictive maintenance, spare parts, repairs, modifications and upgrades, rentals and other cutting-edge digital services.

For the third consecutive year, Carrier achieved double-digit aftermarket growth in 2023. Our expanded Abound and Lynx offerings accelerated recurring revenues while helping customers achieve their sustainability goals. Across all business segments, insights from our connected devices help increase energy efficiency, optimize performance and implement solutions before issues arise. We also grew our catalog of parts, services and connected solutions.

| | | | | |

20222024 Proxy Statement | 37 |

ENVIRONMENTAL, SOCIAL & GOVERNANCESustainability

Carrier 2030 Environmental, Social & Governance (ESG) Goalsis developing visionary breakthroughs today to create a better tomorrow. Our solutions help customers achieve their decarbonization targets. We also incorporate sustainable practices throughout our global operations.

Carrier is leading the way to a more sustainable future. Our 2030 ESG goals underscore Carrier'sCarrier’s commitment to the things that matter and to continuously challenge ourselves to think bigger and to be better. Expanding on three decades of environmental targets, our goals include measures to improve our planet, our people and our communities.communities through sustainable solutions, investments and practices. We strive to be a catalyst for positive and sustainable change as we innovate, empower our people and operate with integrity. That is The Carrier Way.

| | | | | | | | | | | |

| | | |

Our Planet

Climate change is among the most significant issues facing humanity. HVAC contributes an estimated 15% of the world’s greenhouse gas emissions. More than one-third of all food produced is wasted every year, resulting in an estimated 4.4 gigatons of greenhouse gas emissions. We recognize the potential for smart, sustainable innovation, and are committed to setting science-based emissions targets aligned with the goals of the Paris Agreement.

| | | ▪Reduce our customers’ carbon footprint by more than 1 gigaton

▪Invest over $2 billion to develop healthy, safe, sustainable and intelligent building and cold chain solutions that incorporate sustainable design principles and reduce lifecycle impacts

▪Achieve carbon neutral operations

▪Reduce energy intensity by 10% across our operations

▪Achieve water neutrality in our operations, prioritizing water-scarce locations

▪Deliver zero waste to landfill from manufacturing locations

▪Establish a responsible supply chain program and assess key factory suppliers against program criteria

|

| | | |

| | | |

| | | |

Our People

Our greatest strength is the diversity of our employees and their ideas. We are a company of innovators and problem-solvers who are united by The Carrier Way – our purpose, values and culture.

| | | ▪Exceed benchmark employee engagement

▪Achieve gender parity in senior leadership roles

▪Achieve a diverse workforce that represents the communities in which we live and work

▪Foster the growth of Employee Resource Groups ("ERGs") to drive social impact

▪Maintain world-class safety metrics

|

| | | |

| | | |

| | | |

Our Communities

Decades of leadership in sustainability have guided Carrier to the forefront of healthy buildings, healthy homes and a more connected cold chain. Throughout our global operations, we are reducing our environmental footprint and making investments that have a positive impact on society.

| | | ▪Positively impact communities by enabling access to safe and healthy indoor environments, alleviating hunger and food waste, and volunteering our time and talent

▪Invest in science, technology, engineering and math education programs that promote diversity and inclusion

▪Promote sustainability through education, partnerships and climate resiliency programs

|

| | | |

| | |

Learn about our goals and progress at corporate.carrier.com/esg-report |

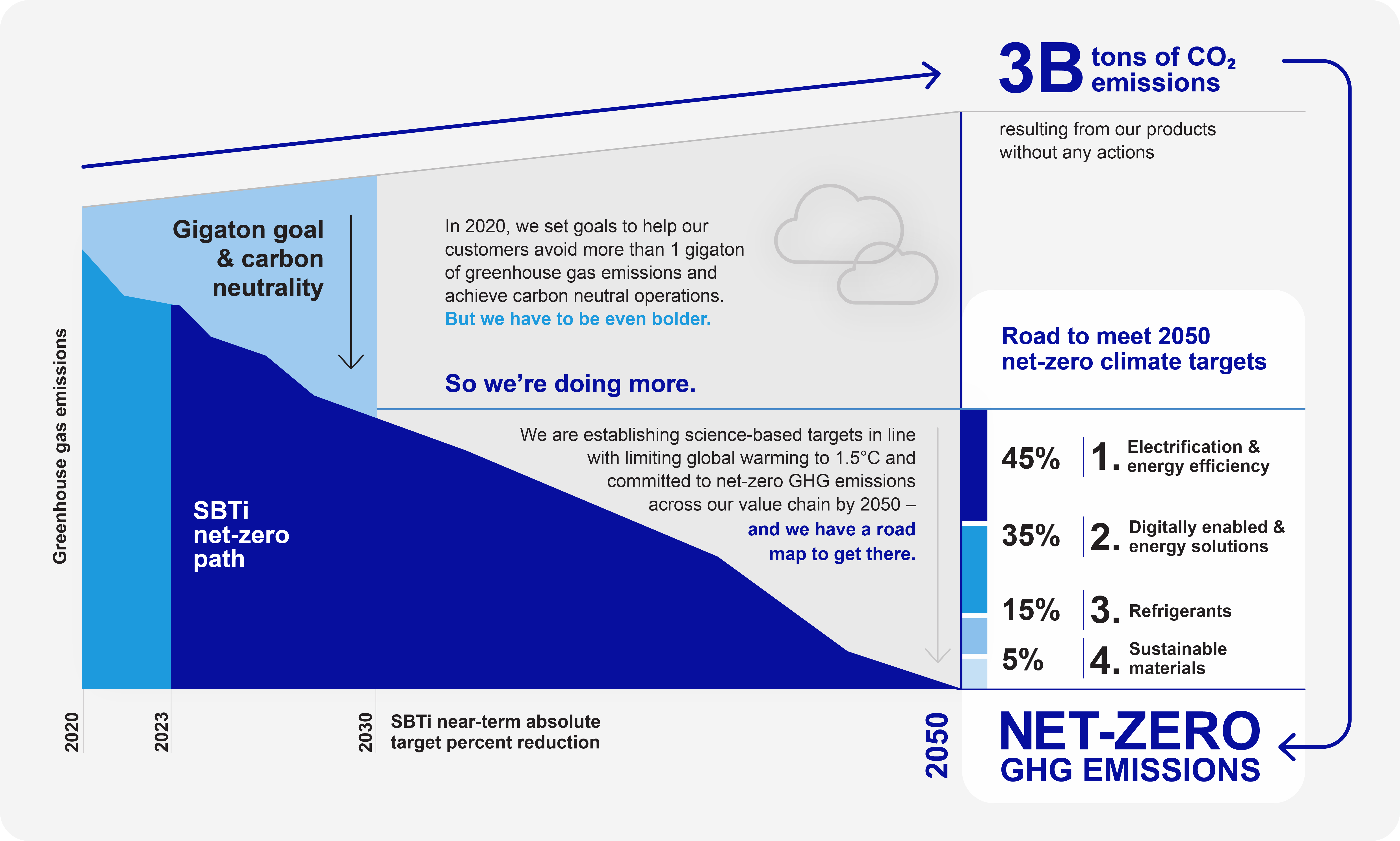

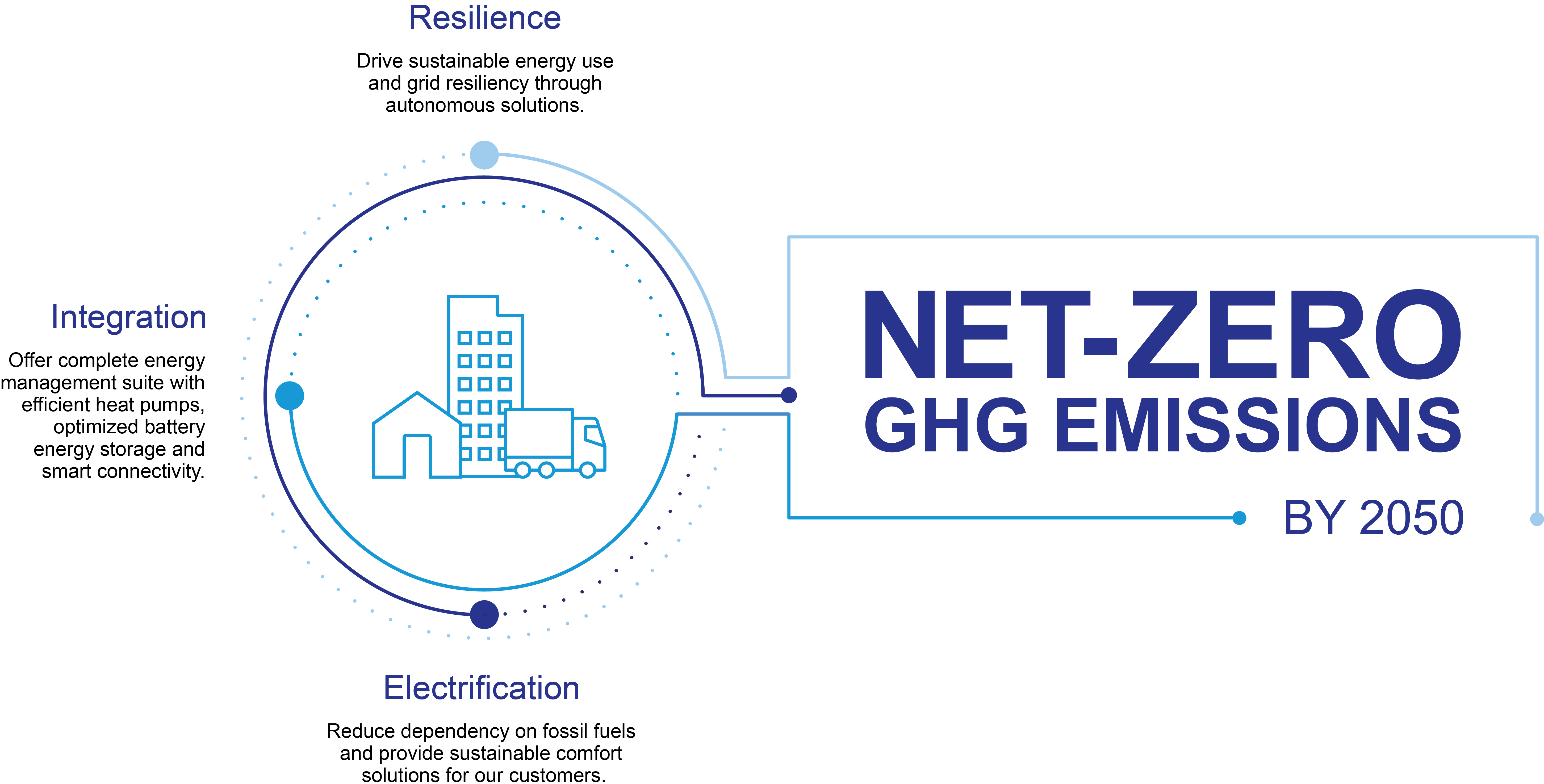

In addition, Carrier committed to setting near- and long-term greenhouse gas emission reduction goals in line with the Science Based Targets initiative to limit global warming to 1.5°C. In accordance with this initiative, we unveiled our road map to achieve net-zero greenhouse gas emissions across our value chain by 2050. We also joined the Corporate Coalition for Innovation & Technology toward Net Zero, a business alliance dedicated to helping countries meet decarbonization and climate change goals.

Carrier's Road Map to Net Zero

| | | | | |

48 | Carrier Global Corporation |

Sustainable Solutions

Environmental, SocialCarrier’s road map involves strategically transforming our portfolio through electrification, integration and Governance

Sustainability

At Carrier,resilience. By providing sustainable solutions, we are driving sustainabilityalso advancing toward our goal of helping customers avoid more than 1 gigaton of greenhouse gas emissions by 2030. Our products, services and digital capabilities help customers meet their energy, carbon and food-waste reduction goals. Energy-efficient heat pumps, all-electric refrigeration and building solutions, refrigerants with lower global warming potential and connected technologies are just a few of the ways we are improving efficiencies in buildings, andin homes and across the cold chain.

Sustainable Investments

We have invested more than $965 million in sustainable research and design since 2020. Additionally, our global venture capital group, Carrier Ventures, expanded its portfolio of strategic partnerships with high-growth companies to accelerate the development of sustainable innovations and disruptive technologies for building and cold chain and we are inspiring confidence in a brighter future. net-zero solutions.

| | | | | |

| |

| Sustainable Innovations | We focus on growth areas of electrification, energy management, and residential and light commercial HVAC technologies. |

| |

| |

| Strategic Collaboration | We value strategic partnerships that enhance our research and development expertise and our channel to market or that become a part of our product offerings. |

| |

| |

| Disruptive Technologies | We prioritize software, analytics and telematics. |

| |

| |

| Commitment to Excellence | We seek out companies that share our core values of respect, integrity, inclusion, innovation and excellence. |

| |

Sustainable Practices

We continue to deliver innovative products and services that help customers avoidincorporate sustainable practices aimed at reducing greenhouse gas emissions, while reducing our own environmental footprint throughout our global operations.energy consumption, water withdrawal and waste to landfill. We are helping address global challenges by innovating solutions and services that enable our customers to achieve their sustainability goals and by making sustainable enhancements across our operations.

Our efficient solutions and intelligent building systems reduce energy consumption and resulting emissions. Ourexpanding the use of advanced, connected technologies andhigh-efficiency equipment, refrigerants with lower global warming potential, refrigerants are contributingelectric technologies and renewable energy. We achieved zero waste to alandfill certification at 11 additional manufacturing sites in 2023 by transitioning to more healthy, safe, sustainable and intelligent cold chain. These solutions, along with our overall ESG progress, led to Newsweek recognizing Carrier as onemethods of America’s Most Responsible Companies.waste management.

Inclusion & Diversity

| | | | | |

We continueOur inclusion philosophy, _belong, underscores the importance of culture in a diverse workplace where everyone can come to advance our inclusionwork – every day – and diversity ("I&D") strategy. Carrier remains steadfast in our goal to create a workplace that is truly and genuinely inclusive, and where all employees feel like they _belongbelong. To build upon that philosophy, in 2023, we introduced ally, which isoutlining our I&D philosophyprinciples for how employees can contribute to building an inclusive culture, globally. Our ally principles include advocate, listen, learn and brand. Our strategy consists of four key tenets: Reduce the Gap, Develop & Sponsor, Drive Inclusion and Lean Forward.yield.

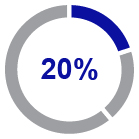

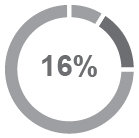

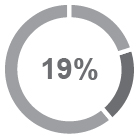

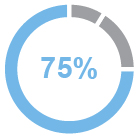

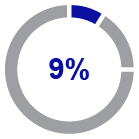

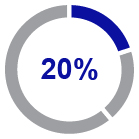

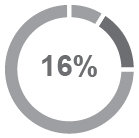

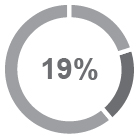

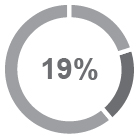

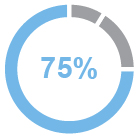

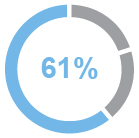

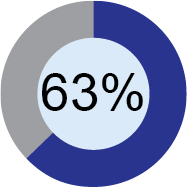

2023 Diversity Representation | |

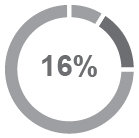

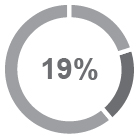

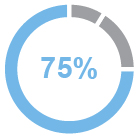

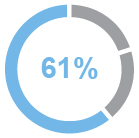

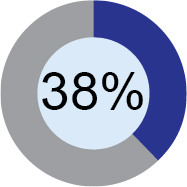

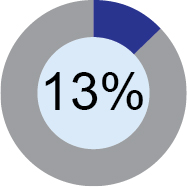

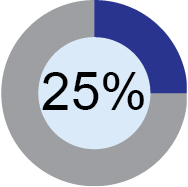

Reducing the Gap | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Global executive diversity* | | Global women executives | | U.S. People of Color executives | | U.S. People of Color professionals | |

| | | | | | | | |

| | | | | | | | |

| 27% in 2015 48%50%

in 20212023 | | 20% in 2015 32% in 20212023 | | 13% in 2015 33% in 2023 | | 18% in 2015 27% in 20212023 | | 18% in 2015

24%

in 2021

| |

| | | | | | | | |

*Global women and U.S. People of Color. |

We also sponsor multiple ERGs, such as the* Global women and U.S. People of Color.

Our global Employee Resource Groups (ERGs) include Carrier Black Alliance, Carrier Hispanics & Latinos Employee Engagement Resource group,Group, Military & Veterans, Pride, Women Empowerment at Carrier and United Carrier Asian NetworkNetwork. They reflect the diversity of Carrier’s workforce; foster a culture of inclusion, allyship and Women Empowerment at Carrier. Thesesponsorship for all; and continue to be open to all employees. Our ERGs leadled sessions on networking and career planning and held grassroots efforts to solve problems and enhanceevents throughout the year. In Japan, with our position in the marketplace.

To strengthenrecent acquisition of Toshiba Carrier Corp., we expanded our diverse talent pipeline, we participate in recruiting eventsefforts with the National Societycreation of Black Engineers, where we serve on the Board of Corporate Affiliates,an inclusion and diversity council.

We maintain partnerships with the Society of Hispanic Professional Engineers and the Society of Women Engineers. Additionally, we established several new scholarship programs at historically Black colleges and universities including Spelman Collegeto strengthen our talent pipeline, and North Carolina Agriculturalwe increased student participation in our six-week leadership program. Mentors from Carrier led workshops on inclusion and Technical State University.diversity, and career preparation.

Carrier Employee Scholar Program

Carrier is committed to the continued development and engagement of our people. We promote continuous learning through our Employee Scholar Program, which covers the cost of an employee’s tuition, academic fees and books at approved universities.

| | | | | | | | | | | |

| | | |

| | | |

| | | |

~$166M+175M invested since inception in 1996 | 50+ countries with employee participation since inception | 8,6008,800+

degrees earned since inception | 690+1,300+

current participants |

| | | |

Environmental,Corporate Social and Governance

Corporate Responsibility

Carrier is committed to makingsupports organizations that promote the world more healthy, safe,planet by advancing sustainable climate solutions, people by developing a skilled and intelligent for generations to come. Asdiverse workforce, and the communities in which we innovate to solve for the planet’s critical challenges, we remain focused on our responsibility to positively impact society by empowering our employees and enriching communities. During a staggering rise in COVID-19 cases in India, employees donated to relief efforts through a matching gifts campaign that helped send healthcare workers and equipment to communities in need. In addition, Carrier is helping The Nature Conservancy make cities more resilient, healthy and equitable. As part of our ongoing three-year, $3 million commitment, Carrier employees participated in a beach cleanup to help beautify the area and protect wildlife, including sea turtles that use the beach for nesting.

Governance

Corporate Governance Practices

Our Board is committed to strong corporate governance practices, which the directors believe are critical to achieving long-term shareowner value and to strengthening Board and management accountability. The following are highlights of our governance framework:

| | | | | | | | | | | | | | | | | |

| | | | | |

Oversight | Independence | Elections | Share

Ownership

| Shareowner

Rights

| Engaged

Board

|

▪Regular reviews of strategic direction and priorities

▪Regular reviews of significant risks; active oversight of Enterprise Risk Management program

▪Annual review of Board policies and governance practices and of committee charters

▪Annual Board, committee and director evaluations

| ▪88% of director nominees are independent

▪All Board committee members are independent directors

▪Robust Lead Independent Director role with explicit responsibilities

▪Regular meetings of independent directors without management

| ▪Annual election of all directors

▪Majority voting for directors in uncontested elections

| ▪Rigorous share ownership requirements for directors and senior management

▪Directors required to hold company-granted equity until retirement

▪Hedging, short sales and pledging of Carrier securities prohibited

| ▪Eligible shareowners can make proposals and nominate directors through proxy access

▪Shareowners may act by written consent

▪15% of shareowners may call special meetings

▪No supermajority shareowner voting requirements

| ▪97% attendance at Board meetings in 2021

▪100% attendance at committee meetings in 2021

|

| | | | | |

| | | | | |

6 | Carrier Global Corporation |

Environmental, Social and Governance

Board Diversity

| | | | | | | | | | | | | | |

Diversity of Director Nominees |

| | | | |

current or

former CEOs

| current or former

CFOs

| racially/ethnically

diverse

| gender

diverse

| independent

directors

|

Attributes expected of all director candidates include the ability to contribute to the diversity of perspectives present in board deliberations. In evaluating the suitability of a candidate, the Board considers many factors, including the candidate's diversity with respect to a broad range of personal characteristics.

The Carrier Way

The Carrier Way is the foundation of everything we do. It defines our vision, reaffirms our values, describes the behaviors that create a winning culture, and establishes how welive, work and win together.

| | | | | | | | | | | |

| | |

| | VISION

Our aspiration; why we come to work every day.

Creating solutions that matter for people and our planet.

|

| | |

| | VALUES

Our absolutes; always do the right thing.

Respect Integrity Inclusion Innovation Excellence

|

| | |

| | CULTURE

Our behaviors; how we work and win together, while never compromising our values.

|

| | |

| | Passion for Customers

We win when our customers win.

| Achieve Results

We perform, with integrity.

|

| | | |

| | Play to Win

We strive to be #1 in everything we do.

| Dare to Disrupt

We innovate and pursue sustainable solutions.

|

| | | |

| | Choose Speed

We focus and move with a bias for action.

| Build Best Teams

We develop diverse teams, and empower to move faster.

|

| | |

Code of Ethics and Corporate Policy Manual

Our Code of Ethics focuses on the core values that serve as the foundation of our culture: respect, integrity, inclusion, innovation and excellence. It builds on the effort we have made across the enterprise to better understand our culture and the values that guide how we operate and achieve our goals the right way. Employees are required to annually review and acknowledge their adherence to our Code of Ethics.operate. We encourage you to visit the Corporate Responsibility section of our website (www.corporate.carrier.com) where you can access Carrier’s Code of Ethics, excerptsto learn more.

We continued to support Habitat for Humanity through volunteer efforts, financial contributions and product donations from our Corporate Policy ManualHealthy Homes suite of indoor air quality and fire safety solutions. Along with other ESG framework documents.companies, we also supported trainings at the United Nations World Food Programme Transport Training Centre in Ghana to enhance cold chain transport and logistics capacities across West Africa. In addition, our Kidde business continued to grow its award-winning Cause For Alarm fire safety education initiative to support communities that are at higher risk of residential fires.

| | | | | |

2022 Proxy Statement10 | 7Carrier Global Corporation |

ANNUAL MEETING AGENDA AND PROPOSALS

Agenda

| | | | | | | | | | | | | | |

Proposal 1 |

Election of the Eight Director Nominees Named in the Proxy Statement |

| | |

| The Board recommends a vote FOR each of the director nominees

|

| u Page 9

|

| | |

| |

| | | | |

Proposal 2 | | |

Advisory Vote to Approve Named Executive Officer Compensation |

| |

| The Board recommends a vote FOR this proposal

|

| u Page 29

|

| |

| | |

| | | | |

Proposal 3 | | |

Ratify Appointment of PricewaterhouseCoopers LLP to Serve as Independent Auditor for 2022 |

| |

| The Board recommends a vote FOR this proposal

|

| uPage 53

|

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

8 | Carrier Global Corporation | | | | | | | | | |

| | |

|

PROPOSAL 1 Election of Directors WHAT AM IARE YOU VOTING ON? OurThe Board has nine members. Eight of our current directors have been nominated by our Board and are standingpresents 10 nominees for re-electionelection as directors at the 20222024 Annual Meeting. One of our current directors is retiring and not standing for re-election but will continue to serve until the 2022 Annual Meeting. For more information, please see "Our Retiring Director" on page 13.

Each director nominee has consented to being named as a nominee in the proxyProxy materials and to serve if elected. Each director elected at the Annual Meeting will serve until the 20232025 Annual Meeting or until a successor is duly qualified and elected. Our director nominees hold andor have held senior positions as leaders of various large and complex global businesses. Our nominees are or have been chief executive officers, chief financial officers, chief accounting officers and members of senior management. Through these roles, our nominees have developed expertise in such areas as finance, human capital management, innovation, digital and technology, international business operations, risk management, sustainability, and strategic planning. With this blend of skills and experience, our directors bring a seasoned and practical understanding of governance, public policy, compensation and sustainabilitysustainable practices to the Board’s deliberations. Detailed biographical information for each director nominee follows. We have included career highlights, other directorships and other leadership and service experience. Our Board considered all of the aforementioned attributes andas well as the results of our annual self-evaluation process when deciding to renominate each of the nominees. |

|

Director Nominees

|

| | | | | | | | | | | | | | | | |

| JEAN-PIERRE GARNIER, 74

Former Chief Executive Officer, GlaxoSmithKline plc

| | DAVID L. GITLIN, 52

Chairman & Chief Executive

Officer, Carrier Global Corporation

| | JOHN J. GREISCH, 66

Former President & Chief

Executive Officer, Hill-Rom Holdings, Inc.BOARD RECOMMENDATION: Vote FOR each director nominee

|

| | | | | |

| CHARLES M. HOLLEY, JR., 65

Former Executive Vice President & Chief Financial Officer,

Wal-Mart Stores, Inc.

| | MICHAEL M. MCNAMARA, 65

Chairman, PCH International Holdings; Former Chief Executive Officer, Flex Ltd.

| | MICHAEL A. TODMAN, 64

Former Vice Chairman, Whirlpool Corporation

|

| | | | | |

| VIRGINIA M. WILSON, 67

Former Senior Executive Vice President & Chief Financial Officer, Teachers Insurance and Annuity Association of America

| | BETH A. WOZNIAK, 57

Chief Executive Officer,

nVent Electric plc

| | |

Proposal 1: Election of Directors — Criteria for Board Membership

Criteria for Board Membership

As discussed below, onThe Board reviews the recommendationappropriate attributes, skills and experience required of the Governance Committee (the “Committee”),directors and the Board amended the Corporate Governance Guidelinesas a whole through its annual self-evaluation process described below. These criteria, which are set forth in 2021. The amended and renamedCarrier's Corporate Governance Principles, have, among other things, enhanced the criteria for board membershipare designed to more appropriately reflect Carrier’s evolving business requirements as well asand to promote the long-term interests of Carrier, its shareowners and other stakeholders.

| | |

|

The Board recognizes that the long-term interests of Carrier and its shareowners are also advanced by responsibly addressing the concerns of other stakeholders, including Carrier employees, customers, suppliers and communities.communities, and stewardship of our planet. |

|

Key Attributes

The Board believes that the following attributes are essential for all Carrier directors:

| | | | | |

| |

•▪Objectivity and independence

•▪Sound judgment

•▪High integrity

•▪Effective collaboration

| •▪Loyalty to the interests of Carrier and its shareowners

•▪Ability and willingness to devote the time necessary to fulfill a director’s duties

•▪Ability to contribute to the diversity of perspectives present in the Board’s deliberations

|

| |

In addition to these attributes, in evaluating the suitability of a candidate, the Board also considers many factors, including the candidate's:

| | | | | |

| |

•General understanding of global business, finance, risk management, technology and other disciplines, and policy matters relevant to the success of a large publicly traded company

•Understanding of Carrier’s business and industry

•Senior leadership experience

| •Educational and professional background

•Personal accomplishments

•Diversity with respect to a broad range of personal characteristics

|

| |

The Board believes that our current directors possess and demonstrate these attributes and bring a strong blend of skills, experience and diverse backgrounds and perspectives to our deliberations.

| | |

The Board’s consideration of its diversity with respect to a broad range of a candidate’s personal characteristics demonstrates our commitment to inclusiveness and our conviction that our greatest strength is the diversity of our people. |

| | | | | |

10 | Carrier Global Corporation |

Proposal 1: Election of Directors — Criteria for Board Membership

Key Skills and Experience

In addition to the attributes expected of each director, the Committee in consultation with the Board has identified additional skills and experience that are essential to the oversight and implementation of Carrier’s strategy and business requirements.

| | | | | | | | | | | |

| | | |

| Financial | | Senior leadership of a financial function and/or management of a large business, resulting in a proficiency with complex financial management, financial reporting, capital allocation, capital markets, and mergers and acquisitions — reflecting, among other things, the paramount importance we place on accurate financial reporting and robust financial controls and compliance. |

| | | |

| | | |

| Human Capital Management | | We believe that our employees are our most important asset and that, in turn, our success and growth depend in large part on our ability to attract, retain and develop a diverse population of talented and high-performing employees at all levels of the company. This is why we value directors with experience in effectively recruiting, engaging, developing and retaining a talented workforce. |

| | | |

| | | |

| Innovation, Digital and Technology | | Experience with or oversight of innovation (including developing and adopting new technologies), digital solutions, engineering, information systems and cybersecurity. |

| | | |

| | | |

| International Business Operations | | Carrier has operations around the world, and a significant portion of our sales derive from outside the United States. Directors with international business experience impart valued business, political and cultural perspectives in the Board’s deliberations. |

| | | |

| | | |

| Knowledge of Company/Industry | | Knowledge or experience with Carrier’s businesses and/or products and services, whether acquired through service as a senior leader or board member of a relevant business. |

| | | |

| | | |

| Marketing/Sales | | This experience is beneficial as we implement our three-pillar growth strategy, focused on strengthening and growing core businesses, increasing product extensions and geographic coverage, and growing services and digital to create recurring sales opportunities. |

| | | |

| | | |

| Risk Management/ Oversight | | This experience is critical to the Board’s role in overseeing and understanding major risk exposures, including significant compliance, cybersecurity, financial, human capital, operational, political, regulatory, reputational and strategic risks. |

| | | |

| | | |

| Senior Leadership | | Extensive leadership experience with a significant enterprise, resulting in a practical understanding of organizations, processes and strategic planning, along with demonstrated strengths in developing talent and driving change and long-term growth. |

| | | |

The matrix on the following page displays the most significant skills and experience of each director. The Governance Committee regularly reviews the composition of the Board to ensure that it maintains a balance of skills and experience and to assess whether there are gaps in light of current and anticipated strategic plans and business requirements.

| | | | | |

20222024 Proxy Statement | 11 |

Proposal 1: Election of Directors — The Board's Self Evaluation Process

Directors’ Key Skills and Experience Summary

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Financial | x | x | x | x | x | x | x | x |

| Human Capital Management | x | x | x | x | x | x | x | x |

| Innovation, Digital and Technology | x | x | x | | x | x | | x |

| International Business Operations | x | x | x | x | x | x | x | x |

| Knowledge of Company/Industry | x | x | | | | x | | x |

| Marketing/Sales | | x | x | x | | x | | x |

| Risk Management/Oversight | x | x | x | x | x | x | x | x |

| Senior Leadership | x | x | x | x | x | x | x | x |

The Board’s Self-Evaluation Process

| | | | | |

The Board appreciates that robust and constructive self-evaluation is an essential element of good corporate governance, Board effectiveness and continuous improvement. To this end, the Board evaluates annually its own performance and that of the standing committees and individual directors.

The self-evaluation informs the Board’s consideration of the following:

▪Board roles

▪Succession planning

▪Refreshment objectives, including membership criteria, composition and diversity

▪Opportunities to increase the Board’s effectiveness, including the addition of new skills and experience.

Dr. Garnier, our Lead Independent Director who also chairs the Governance Committee, guided the 2021 evaluation process after first consulting with the Committee and the Board as a whole regarding his recommended approach.

Dr. Garnier then conferred with the directors individually to allow for their candid assessments of peer contributions and performance, and Board and Committee effectiveness. Afterwards, Dr. Garnier provided a summary of his conversations to the Board, which included feedback regarding the following topics:

| The Governance Committee is responsible for and oversees the design and implementation of the annual self-evaluation process.

Our Lead Independent Director leads this process.

|

| | | | | |

| |

▪Director orientation and continuing education opportunities regarding Carrier and its businesses

▪The size of the Board and the diversity of the directors’ skills, experiences and personal characteristics

▪The effectiveness of the Board and the three standing committees

| ▪Time allotments for Board and committee discussions and deliberations

▪The CEO evaluation process

▪Board meeting topics and meeting preparation materials

▪The effectiveness of management’s relationship with the Board

|

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

12 | Carrier Global Corporation |

Proposal 1: Election of Directors — Nominees for the 2022 Annual Meeting

Board Refreshment and Nomination Process

As discussed above and below, the Governance Committee periodically reviews the criteria for Board membership. That review complements the Board’s annual evaluation of its effectiveness, which considers the following with regard to the Board’s composition and the nomination of candidates for election:

| | | | | | | | | | | | | | |

| | | | |

Does the Board reflect the appropriate mix of skills and experiences, and a diversity of perspectives and personal characteristics that continuously improve oversight? | } | Based on these considerations, the Board adjusts its recruitment priorities. | } | | ▪Elected new Chairman

| | ▪Appointed Beth Wozniak, who brings industry and spin-off experience, as well as digital and technology expertiseProposal 2: NEO Compensation | ▪Increased Board diversity and broadened skills and experienceAudit Matters | | | | | |

The Committee considers candidates recommended by the directors, management and shareowners who satisfy the criteria the Board seeks in its directors. A shareowner may recommend a director candidate by writing to Carrier’s Corporate Secretary (see page 59 for contact information). The Committee also may engage search firms to assist in identifying and evaluating candidates and to ensure that the Committee is considering a larger and more diverse pool of candidates.

The Board believes that new ideas and perspectives are critical to a forward-looking Board, as are the valuable experiences and deep understanding of Carrier’s business that a longer serving director offers. Our Corporate Governance Principles and Bylaws do not impose term limits on directors because the Board believes that a director who serves for an extended period will be uniquely positioned to provide insight and perspective regarding Carrier’s operations and strategic direction. Nonetheless, the Corporate Governance Principles require that directors retire at the annual meeting after reaching age 75, unless the Board makes an exception to the policy in special circumstances. Moreover, the Board’s self-evaluation process is expected to contribute to the Committee’s consideration of each incumbent as part of the nomination and refreshment process.

Our Retiring Director

John V. Faraci is retiring from our Board at the end of his current term and, therefore, will continue to serve until but not stand for re-election at our 2022 Annual Meeting. We thank Mr. Faraci for his service as Executive Chairman and a director and wish him continued success in the future.

Nominees for the 2022 Annual Meeting

The Board, upon the recommendation of the Committee, has nominated for election to the Board the eight individuals presented in this Proxy Statement. All are current directors of Carrier and were elected by the shareowners at the 2021 Annual Meeting, except for Beth A. Wozniak who joined the Board in June 2021.

Our Board has nine members. Eight of our directors are standing for re-election to hold office until the next Annual Meeting or until their successors are duly elected and qualified. John V. Faraci is not standing for re-election and will retire from the Board on April 14, 2022.

Ms. Wozniak was identified as a candidate for the Board by a third-party search firm. After reviewing Ms. Wozniak's qualifications and discussing her nomination, the Governance Committee voted to recommend Ms. Wozniak to the Board. Upon the recommendation of the Governance Committee and considering Ms. Wozniak’s qualifications, the Board appointed Ms. Wozniak as an independent director effective June 9, 2021, with a term expiring at the 2022 Annual Meeting.

If, prior to the 2022 Annual Meeting, any nominee becomes unavailable to serve, the Board may select a replacement nominee or reduce the number of directors to be elected. If the Board selects a replacement nominee before the 2022 Annual Meeting, the proxy holders will vote the shares for which they serve as proxy for that replacement nominee.

Director Independence